Sun setting over a traditional British neighbourhood.

Berkeley Group Holdings (LSE:BKG) is a significant UK homebuilder, and I think it could make for a good value investment based on my discounted cash flow analysis. The company is in the FTSE 100, and its main markets are in London and the South East.

Here are the main reasons I think it’s not unlikely the shares could grow 20% over the next 12 months.

Core markets and competition

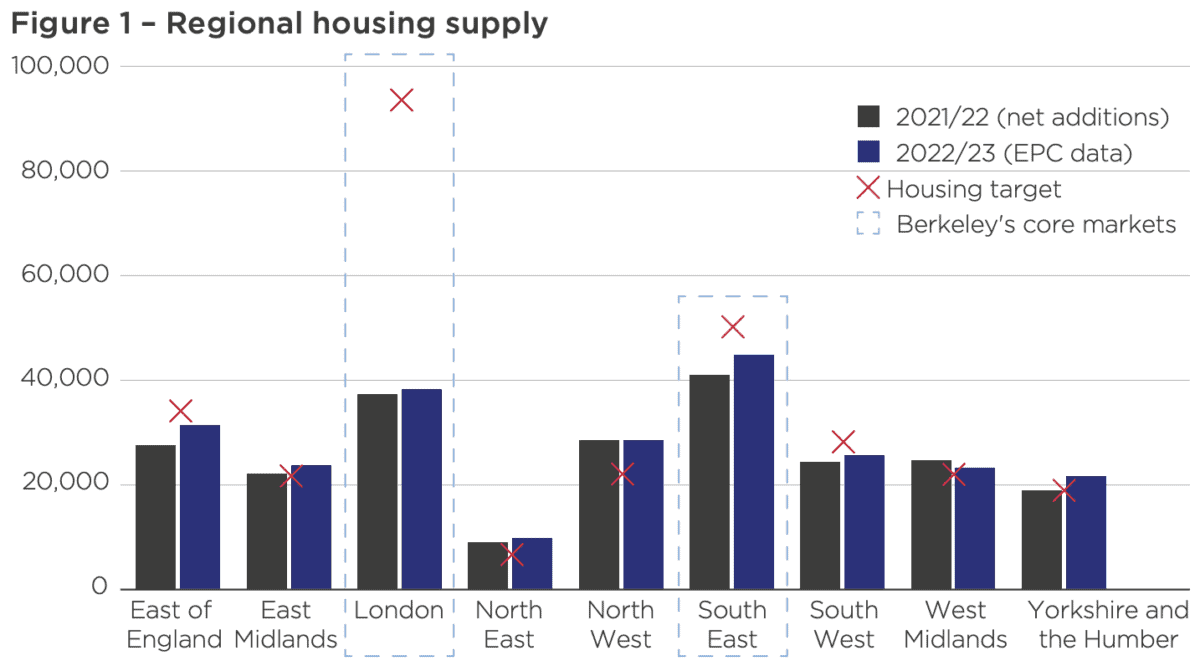

When I was reading the firm’s 2023 annual report, I came across this chart, which shows the investment potential due to housing market growth in Berkeley’s core operating areas in the near future:

Source: Berkeley Group Holdings Annual Report 2023

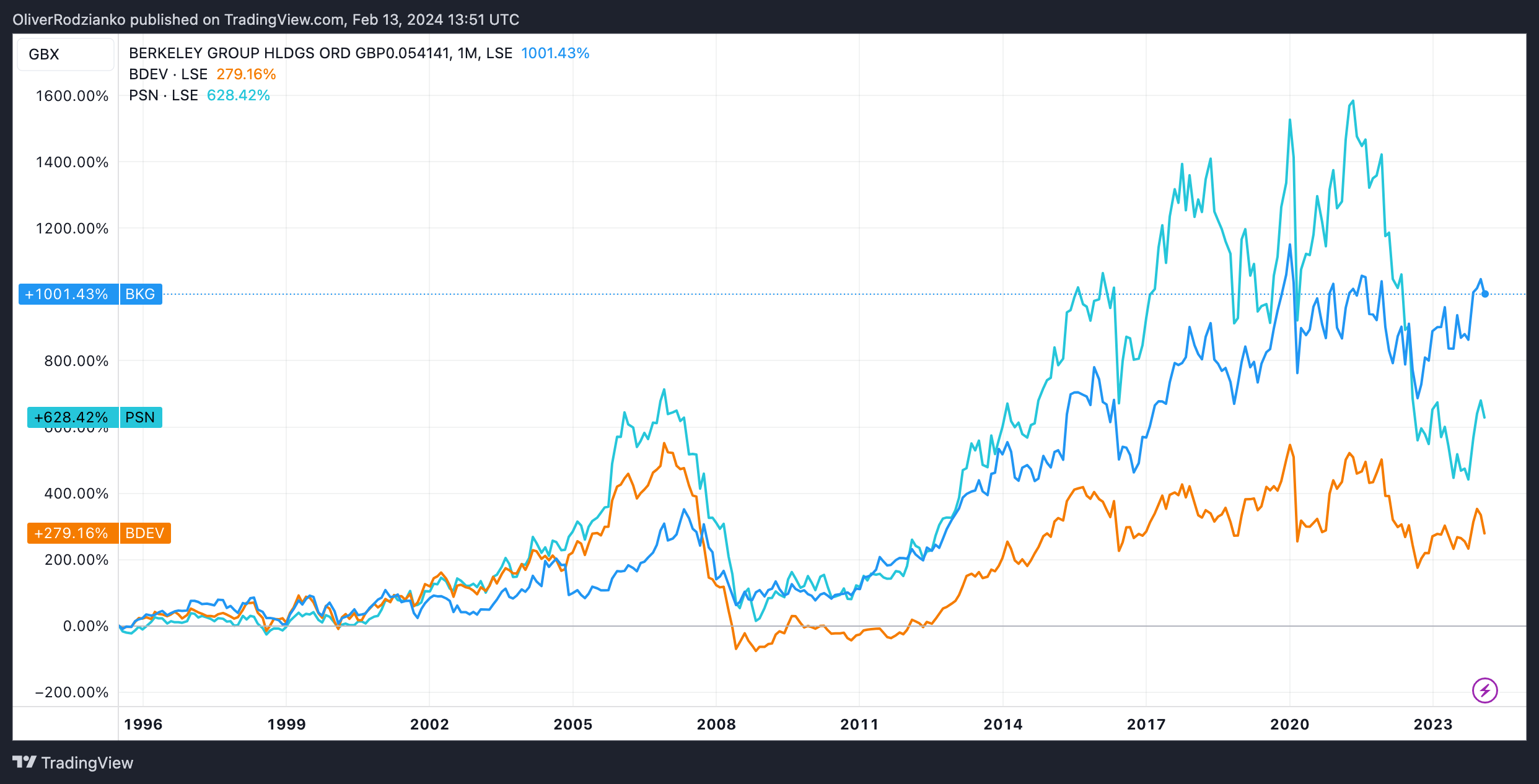

However, that wasn’t enough to pique my interest. I also wanted to know how the business has performed historically against its competition. Therefore, I compared it to two other major UK housebuilding players, Barratt Developments and Persimmon.

First of all, I charted the three investments on historical share price growth, whereby Berkeley has recently taken the lead:

Created at TradingView

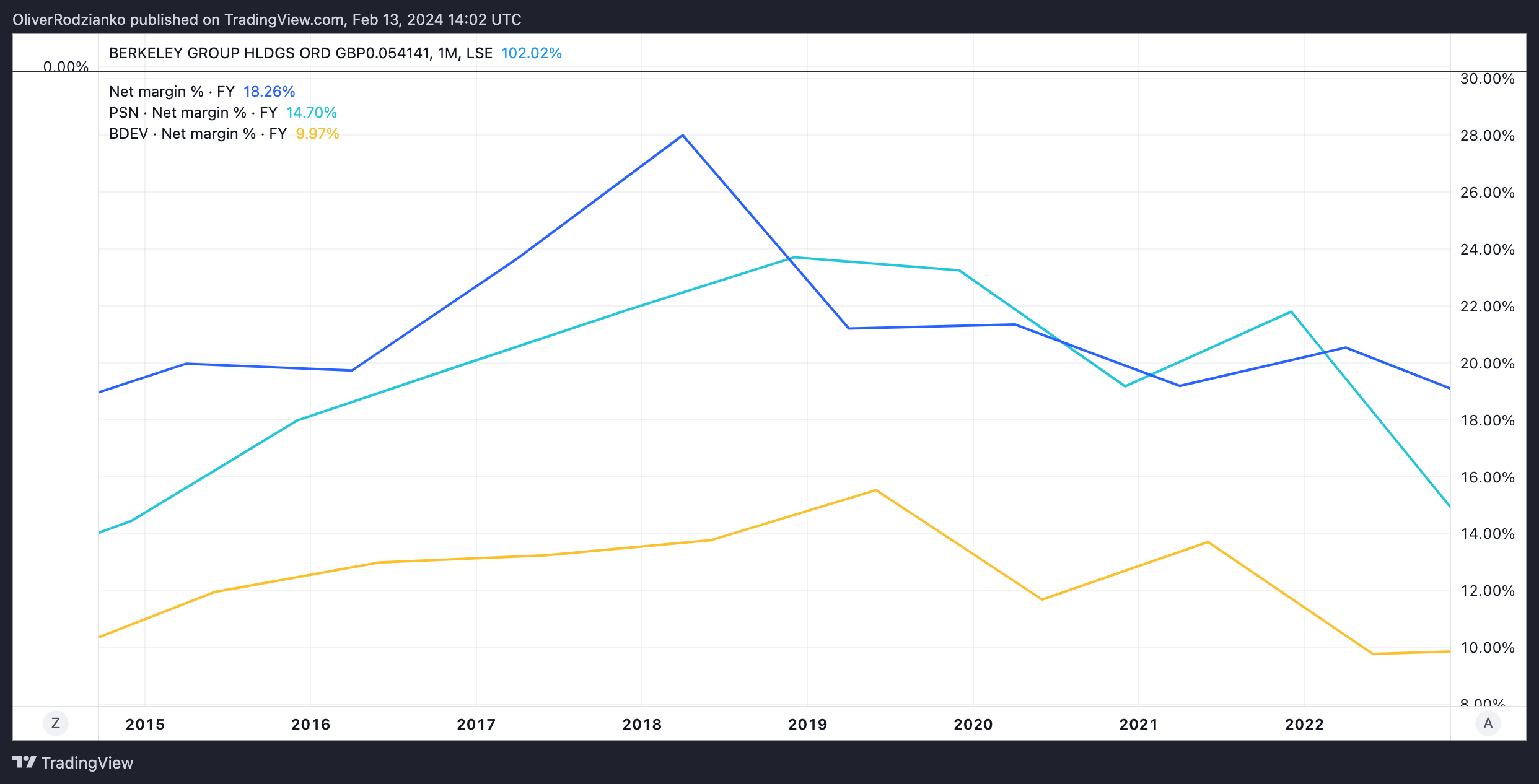

Then, I compared the three companies on net income margin. Berkeley has been consistently at the top of the group and currently retains its number one position:

Created at TradingView

Other financials I like

As well as the abovementioned market opportunities and competitive strengths, there are some other elements I like about the investment.

For example, its balance sheet is stable. While it could be improved, 49% of its assets are balanced by equity, meaning it doesn’t have too much debt at this time.

Also, its three-year revenue growth is very high, reported at 16.4% per year on average.

The 31% discount I noticed

Now, exactly predicting a discount on an investment is essentially impossible, which is why I make estimations based on financial forecasts.

Berkeley has a lot going for it when I look at its future earnings growth relative to its present price. Over the last 10 years, it has grown its earnings at an average of 9% per year.

Therefore, if it can maintain this over the next decade, the shares appear to be selling at a 31% discount at the moment. I used a method called discounted cash flow analysis to calculate this.

If my estimate is correct, the shares could rise in price quicker than normal if the financials remain steady. The reason for this is that investors like myself should pick up on the value opportunity, causing an influx of shares to be bought and the price to rise as a result.

I have a target of 20% in price appreciation in a year. While this isn’t guaranteed, I expect considerable growth in any case.

Critical risks

As seen in my chart above, Berkeley’s net margin is lower than previously at the moment. If this trend continues, it could mean the firm becomes less profitable over the long term, and that could affect my valuation estimate.

Additionally, the company’s dividends have been decreasing by 8.8% on average annually over the last three years. That could be off-putting if I wanted passive income from my investment in the business.

On my watchlist

While Berkeley has a lot going for it, right now, I’m taking my time and not rushing into a decision.

It’s on my watchlist for when I next invest.

Should you invest £1,000 in Berkeley Group right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Berkeley Group made the list?

See the 6 stocks

More reading

Oliver Rodzianko has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

News Related-

Up to 40 Tory MPs ‘set to rebel’ if Sunak’s Rwanda plan doesn’t override ECHR

-

Country diary: A tale of three churches

-

Sunak woos business elite with royal welcome – but they seek certainty

-

Neil Robertson shocked by bad results but has a plan to turn things round

-

Tottenham interested in move to sign “fearless” £20m defender in January

-

Bill payers to stump up cost of £100m water usage campaign

-

Soccer-Venue renamed 'Christine Sinclair Place' for Canada soccer great's final game

-

Phil Taylor makes his pick for 2024 World Darts Championship winner

-

Soccer-Howe aims to boost Newcastle's momentum in PSG clash

-

Hamilton heads for hibernation with a word of warning

-

Carolina Panthers fire head coach Frank Reich after 1-10 start to the season

-

This exercise is critical for golfers. 4 tips to doing it right

-

One in three households with children 'will struggle to afford Christmas'

-

Biden apologised to Palestinian-Americans for questioning Gaza death toll, says report