Stonegate is best known for owning the Slug & Lettuce and Yates pub chains – Greg Balfour Evans/Alamy Stock Photo

It is a damp weekday afternoon and The Bay & Bracket on London’s Artillery Row is virtually empty, save for a solitary pair of businessmen who appear to have slipped away from work early for a drink.

The quiet scene belies the drama unfolding at the sports bar’s parent company, Stonegate. Britain’s biggest pub operator, which is best known for owning the Slug & Lettuce and Yates chains, is struggling under the weight of billions of pounds of debt.

Stonegate, which owns over 4,500 venues including The Bay & Bracket, warned in accounts made public last week of a “material uncertainty” about its ability to continue as a going concern if it cannot refinance more than £2bn of borrowings.

“Whilst there is a plan in place for refinancing this debt, as at the date of signing the financial statements there is a risk that exists over the completion of this exercise,” it admitted.

At another pub visited by The Telegraph, a young part-time bartender shrugged off the company’s worries, uninterested in the corporate drama. Bar staff have been told not to talk about Stonegate’s debt issues.

Not everyone shares this blasé attitude. Fears have been mounting over Stonegate’s debts, which totalled more than £3bn at the end of its financial year, for some time.

It emerged early last year that Stonegate was trying to sell around 1,000 pubs for as much as £800m to pay down borrowings but no buyer was willing to pay the price it wanted. It went on to refinance the pubs for £638m in December.

Stonegate’s struggles are partly driven by a broader downturn in hospitality: people are going out less after the cost of living crisis, costs are rising because of inflation, Gen Z are drinking less alcohol than previous generations and many businesses have Covid loans to repay.

However, Stonegate’s issues are also emblematic of the wider problems facing many private equity-owned businesses.

Companies were turbocharged with cheap cash at a time when interest rates were at record lows. Now, debts that once seemed manageable are fast becoming serious problems.

Stonegate was founded in 2010 when private equity firm TDR Capital bought 333 pubs from All Bar One owner Mitchells & Butlers for £373m. It grew steadily over the decade that followed through a series of deals, snapping up pubs from rivals and rolling them into its own business.

The vast majority of Stonegate’s debts stem from its acquisition of rival pub company Ei Group in 2019, which valued Ei at £3bn and saw Stonegate take on £1.7bn of debt.

The deal took the number of bars and pubs under Stonegate’s control from just under 800 venues into the thousands. But the timing could not have been worse: the deal closed in March 2020, a matter of days before the UK was plunged into lockdown.

“There was good strategic merit in the deal, but very unfortunate timing,” says one pub company executive.

Stonegate had to navigate furlough, the closure of venues for months at a time during lockdowns and a slow and lumpy recovery for the hospitality industry once the pandemic passed.

However, what has proved most painful has been rising interest rates, which have rocketed from 0.1pc in December 2021 to 5.25pc today.

It has pushed up the cost of servicing Stonegate’s debts. Accounts show the company made an operating profit of £68m on revenues of £1.7bn last year, but finance costs of £301m pushed the business to a pre-tax loss of £257m.

It’s a similar story at other private equity backed businesses. Asda, which is also co-owned by TDR, is also racking up interest payments in the hundreds of millions of pounds following its debt-fuelled takeover in 2021.

MPs have grilled TDR and co-owners Mohsin and Zuber Issa over the £6.8bn takeover of Asda and the appropriateness of private equity on the high street more broadly.

Charlotte Nichols, a Labour MP and member of the Business & Trade Select Committee, says the buyout barons should have prepared for the fact that interest rates could rise even before the pandemic.

“To take out a mortgage, that lending is stress-tested at an interest rate up to about 10pc. You have to be prepared for financial circumstances to change,” she says.

TDR co-owners Zuber (left) and Mohsin Issa’s Asda takeover was fuelled by debt – Jon Super

It is not just high interest rates that are putting pressure on Stonegate.

Inflation has pushed up the cost of everything from power to wages and ingredients, putting intense pressure on margins.

“When you’re that big and you’ve got thousands and thousands of businesses, what you need is 2pc, 3pc or 4pc growth every year to make good money,” says a senior industry figure. “The problem right now is you’re getting that small growth, but your input costs are wiping that out.”

Late-night venues have also suffered a dramatic collapse in demand post-pandemic.

“The late-night market has fallen away,” says the pub executive. “Behaviour shifted in Covid away from the late night sector. People go out early, or they finish early, and they spend less when they’re out.”

Cost of living pressures have been blamed for the decline, as have Gen Z customers who are less interested in alcohol than previous generations.

Rekom, the UK’s biggest nightclub company, closed 17 nightclubs in February after falling into administration. Revolution Bars last week announced plans to close 18 bars as part of an emergency rescue plan that will also see it raise £12.5m. It is considering selling itself.

Stonegate is less exposed to the late night sector’s woes thanks to the diversity of its sites – it has sports bars, city pubs, country inns and late night venues – but it has still had an effect.

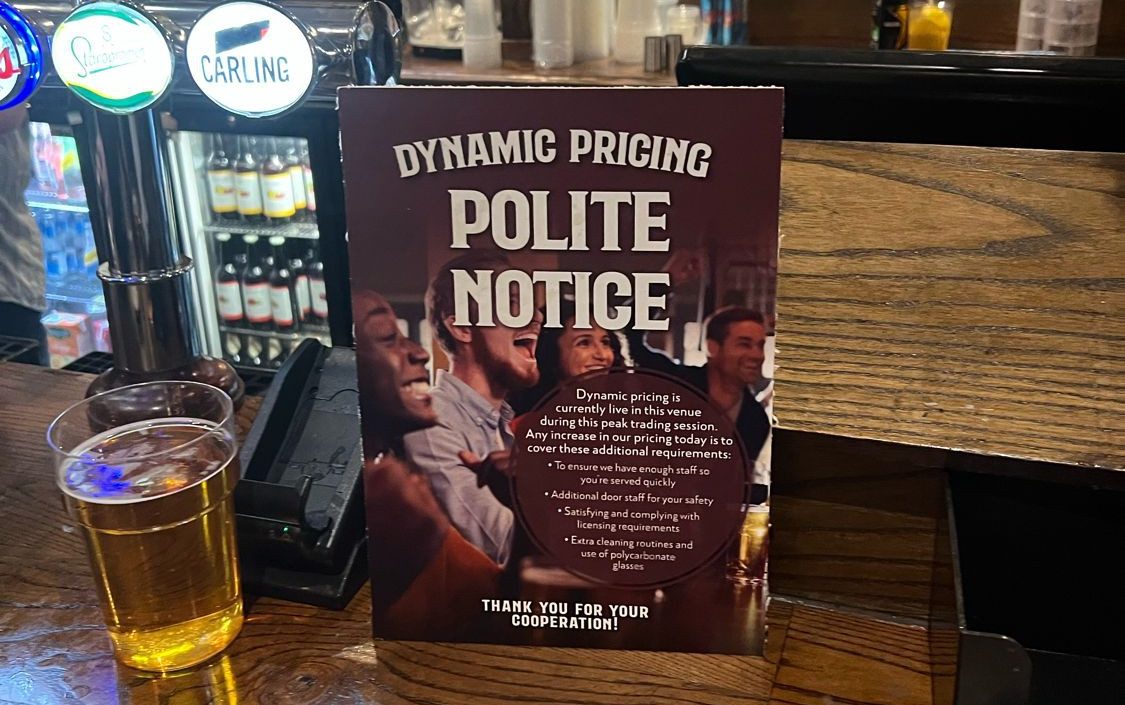

Stonegate has introduced ‘dynamic pricing’ to charge customers more during busy periods

“[Stonegate] is not a basket case, which is what people might think from the outside, but it’s got some problems that they need to work their way through,” the pub executive says.

As the refinancing drags on, the company is making changes in a bid to safeguard its future.

It has slashed hundreds of head office jobs to bring down costs and it is understood to be considering selling a large number of pubs to raise cash.

More controversially, Stonegate has introduced so-called “dynamic pricing”, which sees customers charged more for food and drink during busy periods. The company has defended the practice by saying the extra revenue is needed to cover “additional staffing or licensing requirements such as additional door team members”.

David McDowall, Stonegate’s chief executive, said in a recent update that the company enjoyed a “significant increase in profitability” over Christmas. He told The Telegraph this week he had “real confidence in the future”, pointing to upcoming sports events such as the Euros and T20 World Cup, which should boost business.

Mr McDowall added: “We would also like to assure our valued employees and partners that venues are not at risk.”

Back at the Bay & Bracket, an Indian Premier League cricket game plays out silently on screens dotted around the pub as Let’s Stay Together by Al Green is piped over the speakers. In a few hours, the bar will likely be filled with after-work City drinkers, many none the wiser to the parent company’s troubles.

Play The Telegraph’s brilliant range of Puzzles – and feel brighter every day. Train your brain and boost your mood with PlusWord, the Mini Crossword, the fearsome Killer Sudoku and even the classic Cryptic Crossword.

News Related-

Up to 40 Tory MPs ‘set to rebel’ if Sunak’s Rwanda plan doesn’t override ECHR

-

Country diary: A tale of three churches

-

Sunak woos business elite with royal welcome – but they seek certainty

-

Neil Robertson shocked by bad results but has a plan to turn things round

-

Tottenham interested in move to sign “fearless” £20m defender in January

-

Bill payers to stump up cost of £100m water usage campaign

-

Soccer-Venue renamed 'Christine Sinclair Place' for Canada soccer great's final game

-

Phil Taylor makes his pick for 2024 World Darts Championship winner

-

Soccer-Howe aims to boost Newcastle's momentum in PSG clash

-

Hamilton heads for hibernation with a word of warning

-

Carolina Panthers fire head coach Frank Reich after 1-10 start to the season

-

This exercise is critical for golfers. 4 tips to doing it right

-

One in three households with children 'will struggle to afford Christmas'

-

Biden apologised to Palestinian-Americans for questioning Gaza death toll, says report