House prices will stay static in 2024, according to Zoopla – as buyers take advantage of the flat market to get big discounts.

The property portal revealed that house prices have fallen, though only by 0.3 per cent, in the 12 months to March.

While Zoopla says house prices have slightly recovered from where they were six months ago, it expects prices to flatline into the second half of 2024 thanks to higher mortgage rates and reduced buying power.

On average, sellers are accepting offers that are 4% below asking price, according to Zoopla equating to a £10,000 discount on average

Many buyers are continuing to negotiate hard on price as it largely remains a buyer’s market, according to Zoopla.

Two fifths of sales agreed in March were at a price that was 5 per cent or more below asking, it said.

Half of sales went below asking in the final three months of 2023, but the figure remains high by historic standards.

On average, sellers are accepting offers that are 4 per cent below the asking price, according to Zoopla, shaving off £10,000 or more.

Some buyers are managing to negotiate even better deals, however. Zoopla added that 16 per cent of all buyers were getting 10 per cent or more off the asking price, a reduction of £20,000 or more on average.

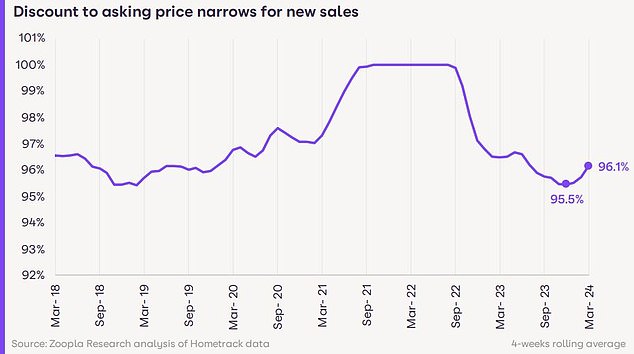

The discounts being achieved have narrowed in recent months.

The average discount being agreed has narrowed from 4.5 per cent last November to 3.9 per cent in March 2024 – the lowest level since July last year.

Analysts at Zoopla say this reflects a combination of greater realism from sellers on their asking price and growing buyer confidence.

Discounts remain larger in London and the South East, where there is an average discount to asking price of 4.3 per cent or £19,500.

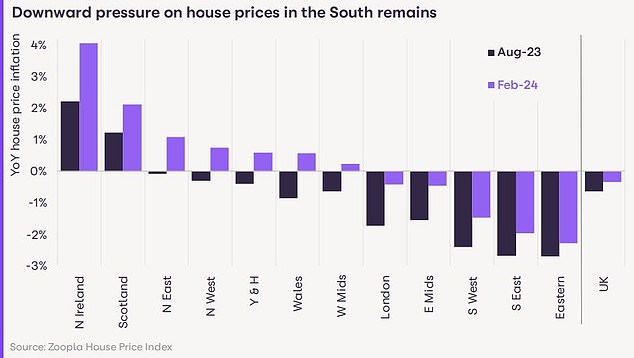

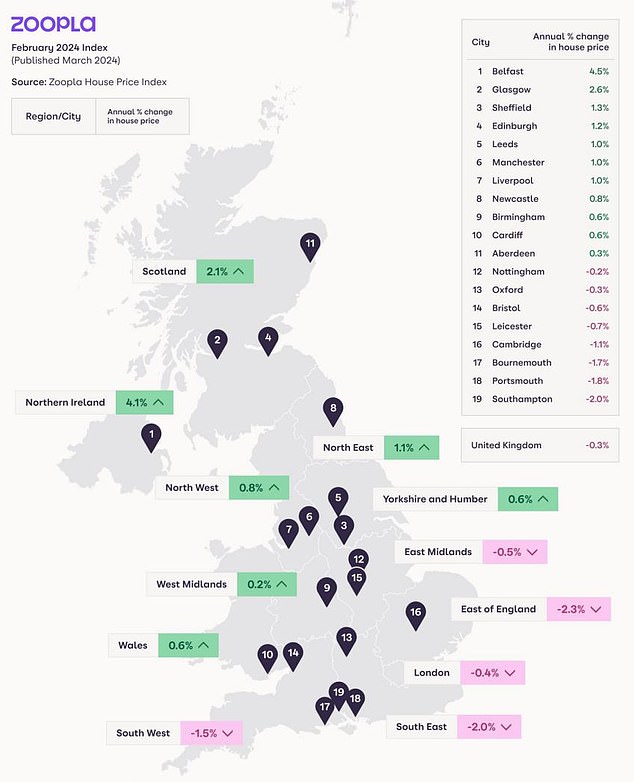

Southern parts of the UK continue to register annual price falls, led by the Eastern and South East regions of England – down 2.3 per cent a 2 per cent respectively.

However, the overall UK average is being propped up by Scotland and Northern Ireland, where average prices are up 2.1 per cent and 4.1 per cent year-on-year.

More house sales are being agreed

While Zoopla is forecasting average house prices to remain broadly flat this year, it is expecting an uptick in the number of sales going ahead.

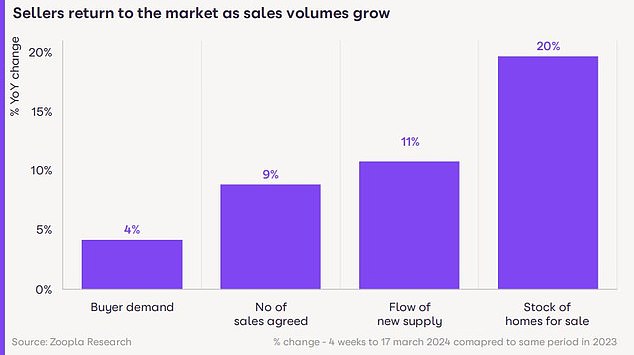

The number of new sales agreed in the first three months of this year was 7 per cent up on the same period in 2023, it said.

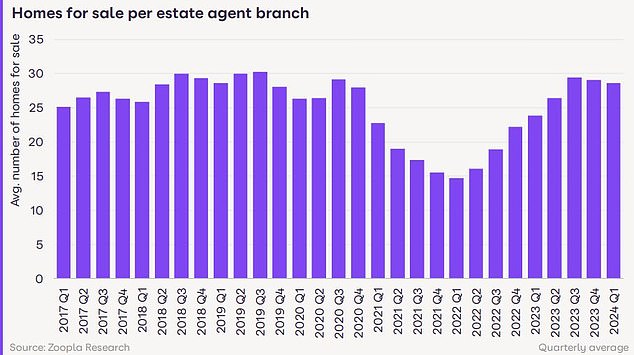

The average agent has also had 11 per cent more homes on the market in the last four weeks than they did at this time last year.

Overall, there are a fifth more homes for sale than at the start of 2023. This greater availability will keep price rises in check, Zoopla said.

More going on: Homes up for sale and the number of sales agreed have risen year on year

Richard Donnell, executive director at Zoopla said: ‘Rising wages and falling mortgage rates have boosted consumer confidence and this is feeding into improving levels of housing market activity over the first quarter of 2024.

‘House prices are falling at a slower rate but it remains a buyers’ market where there is much greater choice of homes for sale.

‘We don’t believe that house prices are about to increase more quickly but there is more buyer interest.

‘Sellers need to remain realistic on where they set the asking price if they are to take advantage of improving market conditions to secure a sale and move home in 2024.’

On the market: More homes are being listed with agents than at this time in 2023

What next for interest rates and the housing market?

What comes next for interest rates largely depends on how quickly the Bank of England decides to start cutting the base rate. That will depend on inflation and other economic factors at play.

At present, markets are pricing in three interest rate cuts in 2024, with the first coming in June.

Economists at Capital Economics have pencilled in the first rate cut for June, but have also suggested the Bank of England will cut base rate to around 3 per cent by late 2025.

That is lower than market forecasts which have priced in a base rate fall to a low of 3.75 per cent.

Expectations of lower interest rates are already priced in to fixed-rate mortgages.

How much can you afford?

Find out how much you can afford to borrow for a monthly payment amount with This is Money’s mortgage affordability calculator.

This is because banks change their fixed mortgage rates pre-emptively, on the back of predictions about where the base rate will ultimately be in the future.

It is why the cheapest mortgage rates are now around 1 percentage point below the base rate.

Market interest rate expectations are reflected in swap rates. These swap rates are influenced by long-term market projections for the Bank of England base rate, as well as the wider economy, internal bank targets and competitor pricing.

Sonia swaps are used by lenders to price mortgages, and these have been rising in recent weeks. This is one of the reasons why some lenders have slightly increased their mortgage rates.

Two-year swap rates are currently at 4.36 per cent and five-year swaps are at 3.81 per cent.

That offers a much more positive picture of the future of interest rates than in summer 2023, when five-year swaps were above 5 per cent and two-year swaps were coming in around 6 per cent.

> Check the latest mortgage rates you could apply for

If mortgage rates fall this should in theory boost buyers spending power as well as market sentiment.

Zoopla’s analysts think that mortgage rates around the 4 per cent range would support sales volumes – but would require incomes to continue to rise faster than house prices to help reset housing affordability, especially in southern England.

Rising household disposable incomes are expected to be the primary driver of improved housing affordability this year.

Disposable incomes are projected to increase by 3.5 per cent over 2024, while house prices look set to remain broadly flat over the year.

Marc von Grundherr, director of Benham and Reeves estate agents said: ‘While we’re yet to see interest rates fall there’s no doubt that the certainty brought about by a continued freeze has helped to improve market sentiment considerably.

‘Despite the disappointment of the Spring Budget, buyer confidence is building and there remains a strong appetite to transact in 2024.

‘Of course, the higher cost of borrowing remains an obstacle, but one that buyers are now willing to tackle with the expectation that rates will fall at some point this year.

‘For sellers, this has resulted in an increased level of interest and we’re also seeing a strong uplift in the number of offers being submitted.

‘Previously, the ability to find a buyer in a proceedable position was a challenge in itself and so there’s no doubt that market conditions have improved in this respect.

‘Price remains the key compromise for sellers when it comes to securing a buyer in today’s market, with higher mortgage rates continuing to restrict buyer purchasing power.

‘However, the gap between this purchasing power price point and seller asking price expectation has narrowed and we’re finding that sellers are more than happy to oblige in order to make their move.’

Regional divide: There is a clear divide across the UK as southern regions continue to register annual price falls, led by the Eastern (-2.3%) and South East (-2%) regions

News Related-

Pedestrian in his 70s dies after being struck by a lorry in Co Laois

-

Vermont shooting updates: Burlington police reveal suspect’s eerie reaction to arrest

-

Grace Dent says her ‘heart is broken’ as she exits I’m A Celebrity early

-

Stromer’s ST3 Urban E-Bike Goes Fancy With Minimalist Design, Modern Tech

-

Under-pressure Justice Minister announces review of the use of force for gardaí

-

My appearance has changed because of ageing, says Jennifer Lawrence

-

Man allegedly stabbed in the head during row in Co Wexford direct provision centre

-

Children escape without injury after petrol bomb allegedly thrown at house in Cork City

-

Wexford gardai investigating assault as man is bitten in the face during Main Street altercation

-

Child minder’s husband handed eight year sentence for abusing two children

-

The full list of the best London restaurants, cafes and takeaways revealed at the Good Food Awards

-

Mazda CEO Says EVs 'Not Taking Off' In The U.S.—Except Teslas

-

Leitrim locals set up checkpoint to deter asylum seekers

-

Ask A Doctor: Can You Get Shingles More Than Once?