This article first appeared in The Edge Malaysia Weekly on November 20, 2023 – November 26, 2023

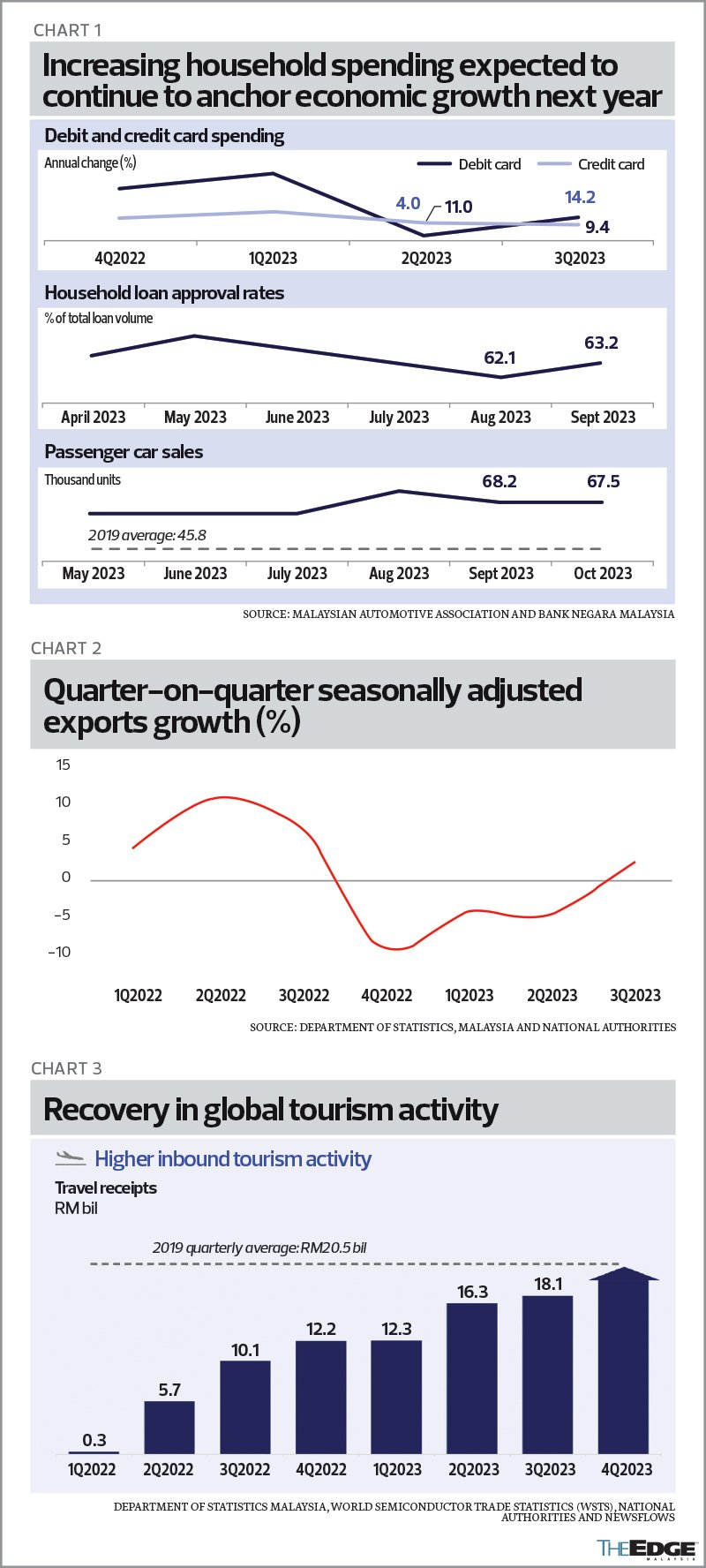

AMID a challenging global environment plagued by geopolitical conflicts, high inflation and elevated interest rates, the Malaysian economy is projected to expand by around 4% this year and between 4% and 5% in 2024 on account of favourable domestic market conditions, progress in investment projects, improvement in the global tech cycle and the continued rise in inbound tourism activity, according to Bank Negara Malaysia governor Datuk Abdul Rasheed Ghaffour.

Speaking to the press at the central bank’s gross domestic product (GDP) announcement for the third quarter of 2023 (3Q2023), Abdul Rasheed noted that the expansion in domestic demand will come amid steady employment and income prospects, particularly in domestic-oriented sectors.

“This growth performance, along with other favourable economic developments, would provide support to the ringgit,” he said, emphasising that household spending will remain the economic anchor for growth, which in turn is expected to be driven by continued employment and improvement in income levels, “sound financial buffers” and support from targeted government measures.

Abdul Rasheed added that Malaysia remains on track to achieve its GDP growth target this year, albeit at the lower end of its forecast range between 4% and 5%.

Malaysia’s economy grew 3.3% year on year (y-o-y) in 3Q2023, driven mainly by private-sector expenditure.

The growth rate, which is slightly higher than the market consensus rate of 3.1%, was a marginal improvement from the 2.9% y-o-y growth in 2Q2023, but lower than the 5.6% y-o-y growth in 1Q2023. Quarter on quarter (q-o-q), the economy expanded by 2.6% in 3Q2023, faster than the 1.5% q-o-q growth recorded in 2Q2023, according to a statement from the Department of Statistics Malaysia (DOSM).

Abdul Rasheed noted that in line with the easing cost environment, headline inflation continued to trend lower, averaging at 2% for the third quarter (2Q2023: 2.8%).

“Much of this downtrend was driven by lower core inflation, which contributed around half of the decline during the third quarter. This also partly reflected effects from the higher base in the third quarter of 2022,” he said, noting that the headline inflation for 2024 is expected to average between 2.1% and 3.6% based on the Ministry of Finance’s (MoF) projections.

The inflation forecast will be subject to domestic policy factors, global commodity prices and financial market developments, he explained.

“As growth in 2024 will be mainly driven by resilient domestic expenditure, inflation is also expected to remain modest,” he assured.

Note that Prime Minister Datuk Seri Anwar Ibrahim, who is also the finance minister, said last month at the tabling of Budget 2024 that a rationalisation of subsidies will be implemented in stages beginning next year. He had said before the budget was tabled that the subsidy bill in 2023 could increase to RM81 billion compared to the budgeted RM64 billion, hence the need for subsidy rationalisation. However, there have been concerns about how the subsidy rationalisation would affect inflation and economic growth.

Pointing to MoF’s 2024 inflation headline forecast of 2.1% to 3.6%, Abdul Rasheed said the wide range in inflation forecast partly accounts for some upside impact from the proposed subsidy rationalisation measures, since specific details of the policies for the rationalisation exercise such as specific timing, magnitude and mitigatory are still being ironed out.

Economist Lee Heng Guie, executive director of the Associated Chinese Chambers of Commerce and Industry of Malaysia’s Socio-Economic Research Centre (SERC) remarks that although public sector spending in the third quarter was stronger, on the private side, growth was still moderate.

“We saw that coming when studying consumption growth in the second quarter as it was still normalising amid high inflation and pressures arising from the cost of living. Amid continual improvements in labour market conditions, real income has still been impacted by cost of living pressures.

“This is rather concerning easing into 2024 with the move on targeted subsidies, where headline inflation is still a wild card pending decisions on petrol and diesel subsidies. It could have an impact on consumer prices and businesses, and therefore, challenge demand,” Lee predicts.

Data from DOSM shows that the unemployment rate declined to 3.4% in the third quarter and is expected to improve further by the end of the year. The gradual decline in unemployment was driven mainly by continued expansion in employment.

“Strong job creation data suggests that employment will continue to expand. Furthermore, the labour participation rate is also at a historical high of 70.1%. These factors would support further growth in income and consumer spending,” said Abdul Rasheed.

It is worth noting, however, that Bank Negara’s projection of an improving trend of consumer spending in 2024 appears to run contrary to studies done by the Malaysian Institute of Economic Research (MIER), which reveal that Malaysian consumers and businesses have grown more pessimistic in 3Q2023 as inflationary pressures eat into spending power, while slowing external demand weighs on sales amid rising operating costs.

The Business Conditions Index continued to decline in 3Q2023, falling by 2.7 points to 79.7 points — the lowest level since 2Q2020 during the initial outbreak of Covid-19 in the country — compared with 82.4 points in 2Q2023 and 99.8 points in 3Q2022, MIER noted.

Export decline bolstered by increase in inbound tourism activity

Abdul Rasheed noted that while exports declined by 12% y-o-y in 3Q2023, compared with -9.4% the same period last year amid the slowdown in global trade in goods and a high base in 3Q2022, this is offset by the higher travel receipts during the quarter.

Abdul Rasheed and SERC’s Lee expect exports to recover gradually, with the pickup in the global tech as well as tourism activity.

“The global semiconductor sales, which have been declining in 1H2023, are showing some signs of turnaround recently. The World Semiconductor Trade Statistics (WSTS) is projecting a positive growth of 11.8% in 2024, as compared to a contraction of 10.3% in 2023, which will help to lift our exports, especially in electrical and electronics products.”

Abdul Rasheed added that tourism-related activities are expected to pick up further.

“In 3Q2023, travel receipts have reached 78% of the corresponding period in 2019. This is expected to continue to recover and return to the pre-pandemic level in 2024,” he forecast, adding that inbound travel recovery is driven mainly by regional tourists from Singapore, Indonesia and Thailand, with Chinese tourists having the largest room for catch-up growth in 2024.

SERC’s Lee, who despite not expecting a global recession in the coming year, will be keeping a close watch on the US economy’s performance in anticipation of a mild decline and its impact on US monetary policy.

“Analysts expect the US Federal Reserve to start interest rate cuts in the first quarter. But labour market statistics have been a mixed bag with job openings falling and jobless claims rising. The Fed may have to look into the timing and quantum of the interest rate cuts,” Lee opines, adding his concerns about the Chinese economy, where its property sector continues to limp along despite a raft of stimulus measures.

“With all the above, Malaysia will still need to depend on domestic demand,” he says, cautioning that certain measures in Budget 2024, such as capital gains tax and higher service tax (excluding the food and beverage and telecommunications sectors) could dampen investor interest and business outlook in the short term.

Meanwhile, Abdul Rasheed stressed that the ringgit’s current value against the US dollar does not reflect Malaysia’s economic fundamentals nor robustness of its financial sector.

He also said that the strong greenback is not expected to derail Malaysia’s growth prospects. “In any case, we may be at the tail end of the US tightening cycle which may lead to more support for the ringgit’s strengthening.”

Last Friday, the ringgit closed at 4.6805 against the US dollar, and 3.4788 against the Singapore dollar.

MIDF Research. in its 3Q2023 economic review after the central bank’s announcement last Friday, noted that several other economies reported stronger GDP growth for the period.

“Among them were the US (2.9% y-o-y) as backed by a strong sequential increase in consumer spending. Regionally, the Philippines (5.9%) and Taiwan (2.32%) reported positive contribution from net exports, as did Singapore (0.7%) on a smaller contraction in its manufacturing sector during the quarter. China’s GDP growth, however, slowed to 4.9% y-o-y due to slower growth in domestic spending,” says MIDF Research, which maintains its 2023 GDP growth forecast for Malaysia at 4.2%.

Meanwhile, OCBC senior Asean economist Lavanya Venkateswaran, believes that the “stable” current account surplus at RM9.1 billion in 3Q2023 supports the Singapore bank’s view for Bank Negara to maintain its policy rate at 3% in 2024. She forecasts Malaysia’s 2023 and 2024 GDP growth at 4% and 4.2% respectively.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple’s App Store and Android’s Google Play.

News Related-

Murder-accused teens 'had preoccupation with torture'

-

A plea for Islamic voices against using human shields - opinion

-

Strengthen MM2H programme, promote multiple entry visa

-

GEG element removed from anti-smoking Bill

-

Health Ministry tables revised anti-tobacco law, omits generational smoking ban

-

Work together with Anwar to tackle economic issues, Perikatan MP tells Muhyiddin and Ismail Sabri

-

Malaysia Airlines launches year-end sale

-

Dr M accuses govt of bribery over allocations

-

Malaysia to check if the Netherlands still keen to send flood experts

-

Appeals court to rule in Isa’s graft case on Jan 31

-

Elephants Trample On Axia With Family Of Three Inside

-

Sirul fitted with monitoring device

-

Nigerian airliner lands at wrong airport

-

Big market marred by poor upkeep