Blue electric vehicle on a green rising arrow with a charger hanging out.

It’s been a car wreck of a year for the Tesla Inc (NASDAQ: TSLA) share price. Yet, investors are still holding out hope after the automaker’s first-quarter results overnight.

Despite missing analyst estimates, shares in the electric vehicle company are up 13% to US$144.60 post-earnings — a welcome sight for shareholders. However, a lot of ground still needs to be covered if Tesla investors hope to finish the year in the green.

Based on last night’s closing price, Tesla shares are the worst-performing of the S&P500. The Elon Musk-led company is down 41.8% year-to-date, as shown below. In contrast, the Standard and Poor’s 500 is 6.9% higher in 2024.

Is the latest set of numbers the kindling needed to reignite Tesla shares?

The numbers

Tesla’s first quarter for FY24 is disappointing in almost whichever way you slice it.

Analysts had tempered expectations earlier in the month after vehicle delivery numbers fell 8.5% year-on-year. Yet, today’s figures still fell below the bar.

- Total revenue down 9% to US$21.3 billion versus US$22.3 billion estimate

- Earnings per share down 47% to 45 US cents per share versus 52 cents estimate

- Operating expenses up 37% to US$2.53 billion

- Cash and cash equivalents up 20% to US$26.9 billion

The company’s presentation mentioned a few inhibitive factors during the quarter.

Firstly, global EV sales were said to be ‘under pressure’ as carmakers shifted their focus to hybrids. Secondly, the Red Sea conflict and an arson attack at the Berlin Gigafactory were called out. Lastly, the slow ramp of the updated Model 3 at its Fremont factory presented a challenge in Q1.

Furthermore, Tesla’s recent vehicle price slashing cut into the company’s revenue and profitability.

Saving grace for Tesla share price

It all sounds unaspiring for an investor… so why is the Tesla share price flying higher in after-hours trade?

Facing a challenging economic environment, it appears Musk now wants to soothe the demand woes. To do so, Musk revealed the company is bringing forward plans for its next-generation, lower-cost model, stating:

We’ve updated our future vehicle lineup to accelerate the launch of new models ahead of the previously mentioned start of production in the second half of 2025.

So we expect it to be like early 2025, if note late this year. These new vehicles, including more affordable models, will use aspects of the next-generation platform, as well as aspects of our current platforms and will be able to be produced on the same manufacturing lines as our current vehicle line-up.

Tesla share price jumps 13% as Elon throws a Hail Mary

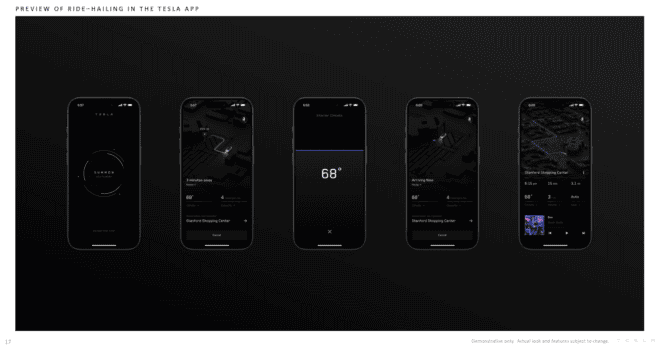

Source: Tesla 2024 Q1 Quarterly Update Deck

The eccentric CEO also leaned further into Tesla’s autonomous ambitions, showing off a robotaxi ride-hailing app, depicted above, in its slides. Musk described how Tesla should be thought of, explaining:

Think of Tesla like, I don’t know, some combination of Airbnb and Uber. Meaning that there’ll be some number of cars that Tesla owns itself and operates in the fleet. There’ll be a bunch of cars where they’re owned by the end user, but that end user can add of subtract their car to the fleet whenever they want.

From there, Musk noted the potential for its vehicles to train AI models, likening it to Amazon’s AWS.

These comments might be sending the Tesla share price higher despite the weak results.

Wondering where you should invest $1,000 right now?

When investing expert Scott Phillips has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for over ten years has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

Scott just revealed what he believes could be the ‘five best ASX stocks’ for investors to buy right now. We believe these stocks are trading at attractive prices and Scott thinks they could be great buys right now…

See The 5 Stocks *Returns as of 1 February 2024

More reading

Motley Fool contributor Mitchell Lawler has positions in Tesla and has the following options: long June 2025 $510 calls on Tesla. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended Tesla. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

News Related-

High court unanimously ruled indefinite detention was unlawful while backing preventive regime

-

Cheika set for contract extension as another Wallabies head coaching candidate slips by

-

Analysis-West's de-risking starts to bite China's prospects

-

'Beyond a joke' Labor won't ensure PTSD protections: MP

-

Formula One season driver ratings: Lando Norris shines as Max Verstappen nears perfection

-

Catalina golfer Tony Riches scores Guinness World Record four holes in one on same hole

-

Florida coach Billy Napier fires assistants Sean Spencer, Corey Raymond with expected staff shakeup ahead

-

Rohingyan refugee NZYQ accidentally named in documents published by high court

-

Colorado loses commitments of 2 more high school recruits

-

Queensland Health issues urgent patient safety alert over national bacteria outbreak

-

Townsville Community Pantry 'distressed' by fruit, vegetable waste at Aldi supermarket

-

What Is The Beaver Moon And What Does It Mean For You?

-

Labor senator Pat Dodson to resign from politics due to health issues

-

Hamas releases 11 more hostages, as Israel agrees to extend ceasefire